Private real estate is drawing increasing interest from investment advisors

As an investment advisor, you know better than others how challenging the past few years have been for income-oriented investors. When the yield on 10-year Treasury notes bottomed out in July 2020, at 55 basis points, the 40-year bull bond market had taken its last breath1. And while yields on the 10-year have recovered (as of mid-May 2021) to pre-pandemic levels2, they remain at historic lows.

Amidst this environment, many investment advisors have turned to other sources of income to meet client needs. Non-investment grade corporate bonds, master limited partnerships (MLPs), and mortgage-backed securities are a few of those options, but each has its own set of additional risks.

Real Estate as an Alternative Income Source

Real estate has long been considered a diversifier that can help reduce portfolio volatility and provide an alternative income source. If you already allocate a portion of your clients’ portfolios to real estate, chances are you are using publicly-traded REITs, real estate mutual funds, or ETFs to access the asset class.

Unfortunately, history shows that publicly traded real estate securities may behave more like equities and fail to provide the diversification benefits many investors desire, especially in times of high market stress. The onset of the COVID pandemic provides an illustration.

“For the full year (2020), the Morningstar US REIT Total Return Index had a correlation coefficient of 0.94 when measured against the broader equity market–the highest it’s been since 2011.”

“Over the past three years, REITs have also moved fairly closely in step with large-cap stocks, with a three-year correlation coefficient of 0.75. That makes REITs significantly less attractive from a diversification perspective.”3

– Morningstar.com

These correlation coefficients suggest that public real estate securities, even if they offer another source of income, can be highly correlated or very highly correlated with equities.

The Private Advantage

Another solution that may provide the portfolio diversification your clients desire and one that has a history of delivering relatively consistent income distributions over several market cycles is private real estate. Once considered the sole investment domain of pensions, endowments, and family offices, private real estate solutions are now available to many individual investors. Moreover, they offer several potential advantages worth your consideration.

Low Correlation to Equities

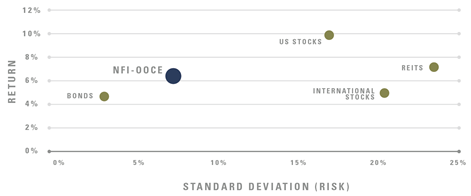

Compared to publicly-traded REITs, private real estate, as represented below by the NFI ODCE Index, may provide lower portfolio volatility than stocks, with attractive risk-adjusted total returns.

RISK & RETURN ILLUSTRATION by ASSET CLASS 15-YEAR ANNUALIZED AS OF Q1 2021

The NFI-ODCE Index is a capitalization-weighted index that tracks the performance of the largest private open-end real estate funds pursuing a core strategy. REITs are represented by the FTSE/NAREIT All Equity REITs Index, stocks are represented by the S&P 500 Index, and bonds by the Bloomberg Barclays U.S. Aggregate Bond Index. An investor cannot invest directly in an Index. International Stocks are represented by the Vanguard Total International Stock Index Fund Investor Shares (VGTSX). 15 Year annualized total returns for all asset classes except VGTSX are shown gross of any investment management advisory fees as of Q1 2021. Standard deviation (risk) is the statistical measure of volatility.

Private Real Estate Returns

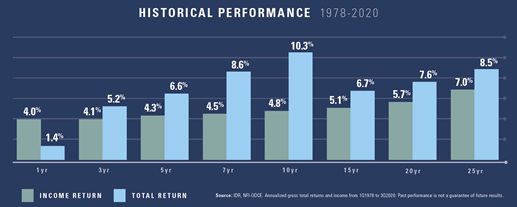

Again, as represented by the NFI-ODCE Index, private real estate has a history of providing compelling income and total returns.

Source: IDR, NFI-ODCE. Annualized gross total returns and income from 1Q1978 to 3Q2020. Past performance is not a guarantee of future results.

Hedge Against Inflation

With recent increases in consumer prices, concerns over a sustained rise in inflation have increased as well. Private real estate may prove to be an effective hedge against the negative impact of inflation on your clients’ investment portfolios and spending power. Unlike stocks and bonds, where inflation directly impacts net returns, private real estate landlords can often sustain investor distribution returns by raising tenant rents as inflation rises.

In addition, since institutional-quality private real estate is generally in high demand and supply often limited, properties have historically held their value or even increased in value during periods of inflation.

Risks and Considerations

As with any investment, private real estate carries certain risks and limitations your clients should carefully assess before investing. In addition to the risks associated with investing in real estate, common challenges expressed by advisors who have considered private real estate strategies include liquidity, fees, and transparency.

Today, there are newer strategies designed to address those concerns, and you can help your clients understand the benefits and risks of these investments to ensure that a private real estate allocation meets their specific goals and objectives.

If you want more info click here. Strategies are exclusively available through USAA Real Estate